The Role of Banking in the Industrial Revolution

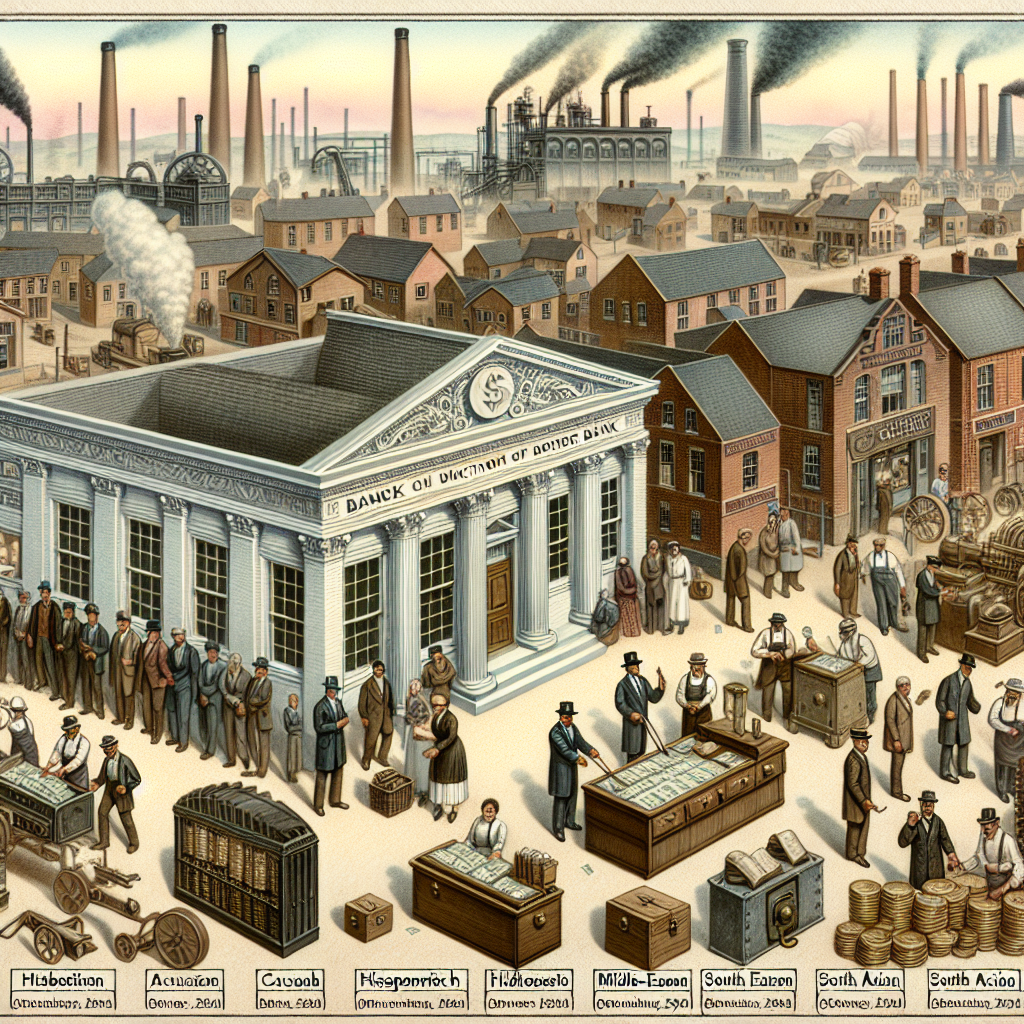

When you think of the Industrial Revolution, images of steam engines, bustling factories, and smoky cities might immediately spring to mind. However, behind the scenes of this transformative era was a powerful engine that wasn’t made of iron or coal—banks. Without the crucial support of banking, the Industrial Revolution might have been no more than a footnote in history. Let’s explore how banking bolstered the incredible advancements of this era.

Banking Becomes the Lifeblood of Industry

The Industrial Revolution, which spanned the late 18th to early 19th centuries, was a period marked by a surge in technological innovation and economic expansion. To facilitate this growth, capital was essential. Just like you need a double espresso to kickstart your Monday morning, industry leaders needed substantial financial backing to turn their inventive dreams into reality.

Banks played a pivotal role by providing the necessary capital through loans to budding entrepreneurs. Entrepreneurs needed large sums of money to invest in machines, factories, and labor—all components crucial to industrialization. Here’s a list of how banks fueled the Industrial Revolution:

- Providing Capital: Banks offered loans, which fueled the establishment and growth of businesses. They funded projects from textile mills to the construction of railways.

- Encouraging Innovation: The availability of capital encouraged inventors to develop new technologies, spurring immense economic growth.

- Facilitating Trade: Banks created a more efficient system of trade by establishing credit systems, enabling businesses to buy and sell goods across borders seamlessly.

- Stabilizing Economies: By regulating cash flow and managing financial risks, banks helped stabilize economies amidst rapid industrial change.

The Emergence of Modern Banking Practices

Before the Industrial Revolution, banking was primarily a service used by the wealthy elite. But as factories sprouted and trade routes expanded, banks evolved rapidly. New banking practices emerged, which included the introduction of joint-stock companies, making it easier for the public to invest in industrial enterprises. It’s kind of like the original crowdfunding, but instead of creating the next famous potato salad recipe, they were building locomotives and ironworks.

This innovation not only democratized investment but also encouraged risk-taking. Entrepreneurs could now pool resources from numerous investors. In addition, the concept of savings banks also took root during this time, encouraging even those of modest means to save and invest in the industrial economy.

Banking’s Influence Continues

While the industrialists of the past laid the groundwork, modern entrepreneurs continue to rely on the wisdom of financial backing. If you’re interested in diving deeper into economic topics and how they shape the present world, you might explore these Best Economic Analysis Telegram Channels that provide rich financial content and analysis.

Today, banks and financial institutions remain a driving force behind innovation and economic development, continuing the legacy of their industrious ancestors. Just imagine a modern world without banking—perhaps even your local coffee shop wouldn’t exist, and that would surely be a catastrophe.

Conclusion: The Unsung Heroes of the Industrial Age

As we gaze back at the era of steam and steel, it’s important to recognize the pivotal role played by the banking industry. Banks didn’t just provide money; they provided the momentum that allowed industrial pioneers to reshape entire societies. As the guardians of capital and risk, banks ensured the smooth workings of industrial advancements, creating an era that forever altered the human landscape.

So, next time you marvel at the wonders of the industrial age, spare a thought for the unsung heroes: the banks and their pivotal role in turning an age of innovation into an age of prosperity. After all, even world-changing revolutions need good accountants!