From Goldsmiths to Modern Banks: Unraveling the Origins of Modern Banking

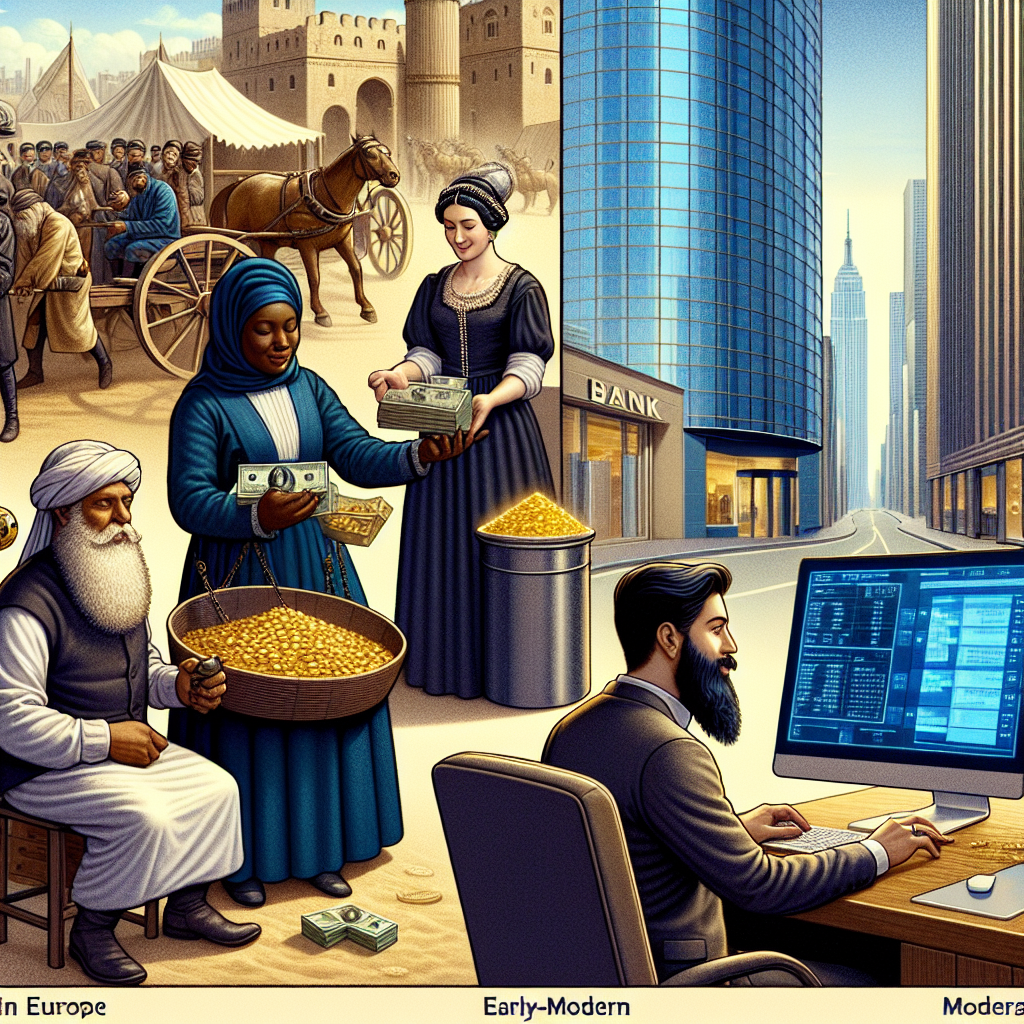

The concrete jungles of today, with their gleaming skyscrapers and bustling financial districts, owe a big nod to a band of merry medieval artisans — goldsmiths! Our modern banking system took root from these rudimentary yet innovative financial practices. Join us on an intriguing journey through time as we draw a timeline from goldsmiths to the marvel of modern banking.

The Beginning: Goldsmiths and Their Strongboxes

In medieval Europe, goldsmiths were the original “safe deposit boxes.” Renowned for their strong safes and precise craftsmanship, these artisans were entrusted with the safekeeping of precious metals and coins. But goldsmiths did more than just safeguard valuables; they initiated the concept of loans and promissory notes. Let’s delve into how their ingenious methods laid the cornerstones for future financial institutions.

Gold Receipts: The Birth of Paper Money

Before banknotes and electronic money transfers, there were goldsmiths’ receipts. When individuals deposited gold with a goldsmith, they received a paper receipt — a proto-version of today’s banknotes. These receipts were portable, divisible, and accepted for transactions, becoming an early form of currency.

The Money Lenders in Asia and Beyond

While goldsmiths were working their magic in Europe, various other forms of proto-banks existed across the globe. In ancient China, merchants engaged in money lending and promissory notes were in use as well. These practices helped further the spread and development of modern banking, blending into an intricate web of financial evolution.

The Bank of England: A Royal Leap Forward

Fast forward to 1694, and we’ve got a game-changer: the establishment of the Bank of England. Funded by individual investors to support the government during wartime, this institution amassed significant capital and issued banknotes, legally backed by its assets. Its success paved the way for large-scale banking worldwide.

Modern Banking: from Ledger Books to FinTech

The quaint days of physical ledger books are now largely a thing of the past. Modern banking practices have evolved into a sophisticated blend of technology and financial wizardry. Today’s institutions operate globally and offer a myriad of services:

- Loans and Mortgages

- Investment Services

- Online and Mobile Banking

- Cryptocurrency Management

Gone are the days of heavy gold coins and receipts. In their place, we have ATMs, online banking, and blockchain technology.

Interesting Tidbits: Did You Know?

Before we wrap up, here are some fascinating tidbits that will make you a hit at your next dinner party:

- The first “ATM” was installed in 1967 at a Barclays branch in London. Feeling anxious about swiping your card? Imagine pushing out money using a six-digit, single-use token!

- Curiosa: Some goldsmiths were so trusted, even monarchs would deposit their treasures with them.

- Paper money is not a 20th-century innovation. The Chinese Song Dynasty was using it as early as the 11th century!

The Future of Banking: What Lies Ahead?

Imagine a future where blockchain technology, AI, and quantum computing revolutionize banking as significantly as goldsmiths did centuries ago. The pace of change is exponential, and very soon, discussions about digital currencies and AI-driven financial services may seem as rudimentary as those gold receipts.

Conclusively, the evolution from goldsmiths to modern banks isn’t just a story of financial innovation; it’s a tale of human ingenuity, trust, and the relentless drive to create systems that safeguard and multiply wealth. It’s a journey worth tracking, one gold receipt at a time!

Thank you for joining us on this historical joyride. Remember, the next time you tap on an ATM or open your banking app, you are interacting with centuries of innovative financial genius!