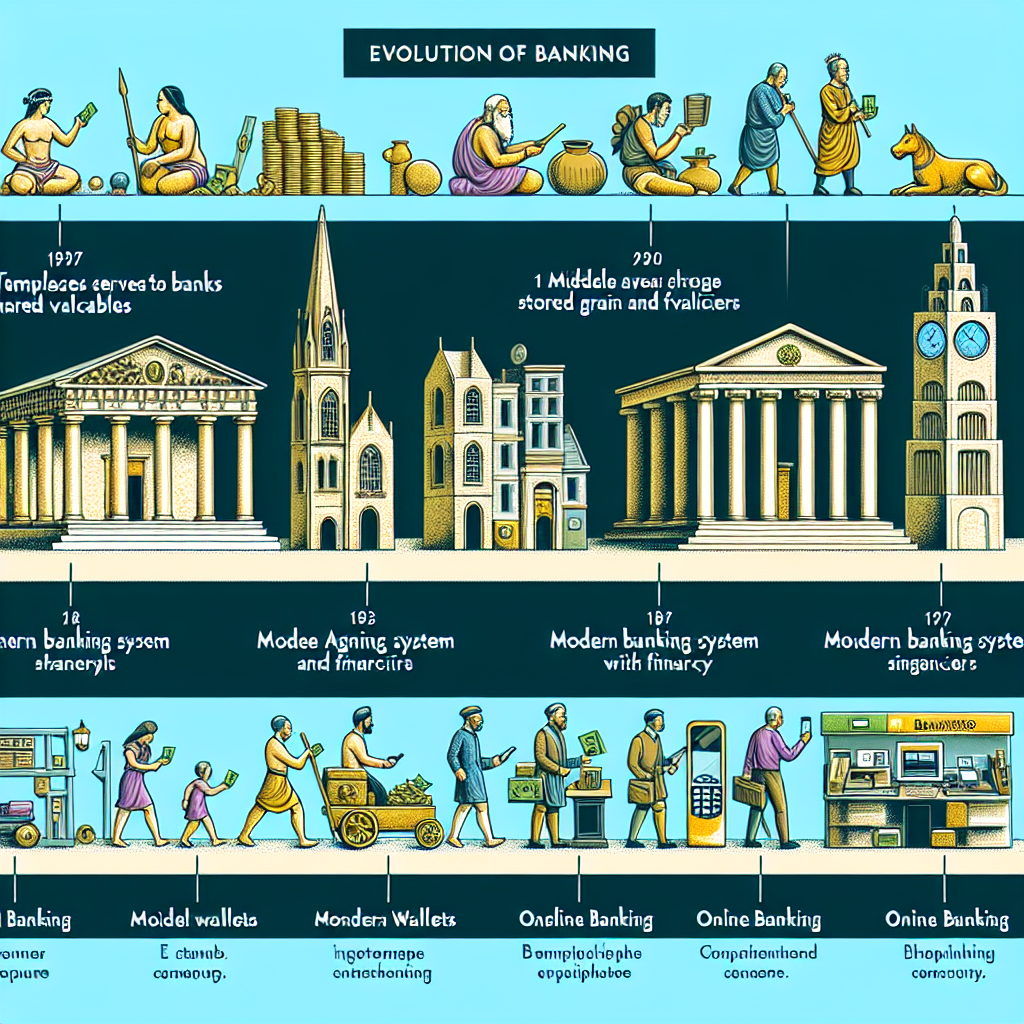

The Evolution of Banking: From Ancient Temples to Digital Wallets

Banking has come a long way from its humble beginnings in ancient temples to the modern, sophisticated digital wallets we use today. Let’s embark on an enlightening journey through time to understand how banking systems evolved and the profound impact this evolution has had on our lives.

Banking in Ancient Times

Believe it or not, banking history dates back to around 2000 BCE in Mesopotamia. Back then, temples and palaces served a dual purpose of worship and finance. These early banks stored grain, silver, and other valuables, acting as the first financial institutions.

The concept of interest wasn’t far behind either. Ancient Babylonian temples lent out grain and charged interest on these loans. If you think your modern bank’s fees are high, consider this: failure to repay could result in becoming a temple slave!

The Rise of Banking Houses in the Middle Ages

The Middle Ages saw the rise of more structured banking systems. Italian merchant families such as the Medici wielded vast economic power and created the banking practices that resemble today’s systems. They introduced letters of credit and the double-entry bookkeeping system, laying the groundwork for modern banking.

Medieval banks became central to trade and commerce, offering services such as money changing, loans, and safe deposits. Despite their success, they weren’t immune to banking crises, with some banks collapsing under the weight of unpaid debts and mismanagement.

The Birth of Modern Banking

The 17th century marked the dawn of modern banking, with the establishment of the Bank of England in 1694. It was the world’s first central bank and played a pivotal role in shaping the financial systems we know today.

Modern banks began to offer more diverse services, including checking accounts, savings accounts, and the issuance of paper money. The Industrial Revolution further spurred the expansion of banking, with financial institutions supporting large-scale industrial ventures and international trade.

Banking in the Digital Age

Fast forward to the late 20th and early 21st centuries, and we witness the advent of digital banking. The introduction of ATMs, online banking, and mobile apps revolutionized how we interact with our money.

Today, digital wallets like PayPal, Apple Pay, and Google Wallet offer unprecedented convenience. These platforms allow users to send and receive money, make purchases, and even invest, all from their smartphones. The blockchain and cryptocurrency phenomenon further expanded the horizons of digital banking, introducing decentralized finance (DeFi) systems.

The Future of Banking

As technology continues to advance, the future of banking likely holds even more exciting developments. Artificial intelligence, machine learning, and enhanced security measures such as biometrics are forever changing the landscape.

Staying informed on economic trends and financial updates is more critical than ever. For the latest economics updates on Telegram, check out these Top Economics Telegram Channels.

Conclusion: A Journey Through Millennia

From ancient grain loans at Babylonian temples to the seamless transactions of digital wallets today, banking has certainly evolved in incredible ways. This journey illustrates human ingenuity and our ever-present drive to improve efficiency and security in managing resources.

Whether you prefer the stability of traditional banks or the cutting-edge features of digital wallets, understanding the history of banking enriches our appreciation of today’s financial technologies.

So the next time you tap your phone to pay—or approve a loan with the swipe of a digital pen—remember the thousands of years of financial innovation that have made it possible.