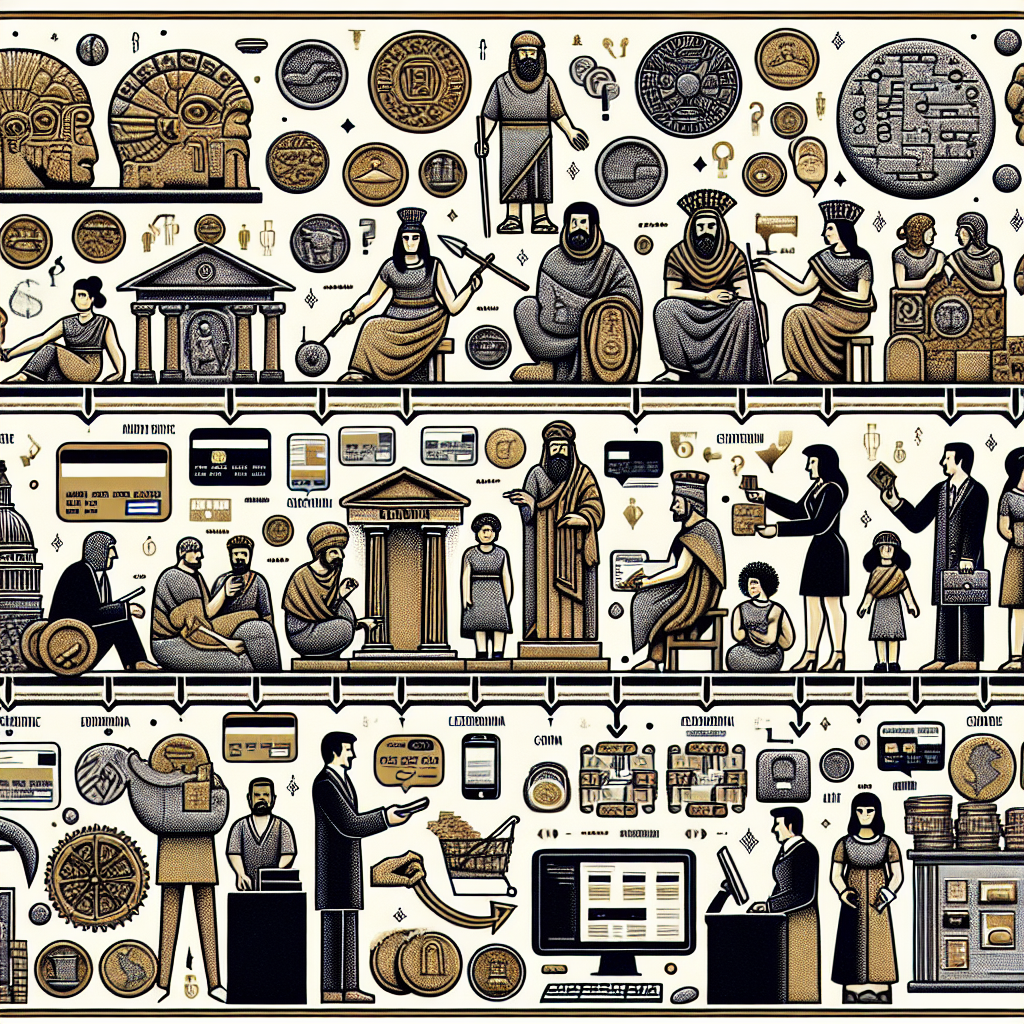

The Origins of Credit and Loans: A Historical Perspective

Ever wondered where the idea of borrowing money and paying it back with interest came from? Well, grab your time travel goggles as we set off on a whirlwind tour through the annals of financial history to explore the fascinating origins of credit and loans.

The Dawn of Credit: Ancient Civilizations

Our first stop takes us back to ancient Mesopotamia, where early forms of loans and credit were already taking shape. The Sumerians, around 3000 BCE, were not just pioneers in writing with cuneiform but also in financial transactions. Clay tablets served as receipts, recording loans of grain and silver, establishing one of the earliest credit systems.

These ancient folks didn’t just stop at simple borrowing! They had detailed records and contractual obligations, much like today’s loans documents. Talk about being ahead of their time!

The Interest-ing Concept of Ancient Egypt and Greece

Fast forward a few centuries, and we find ourselves in ancient Egypt, where credit was often given without interest. However, penalties for late payment acted like our modern-day interest rates—a Pharaoh’s way of saying, “Don’t be late!”

Meanwhile, in ancient Greece, the concept of “interest” truly bloomed. Greeks formalized loans with a specified interest rate, usually ranging between 10% and 20%. Imagine trying to explain modern credit card interest rates to them; they’d probably drop their amphoras in shock!

Roman Republic and Medieval Innovations

The Romans, not to be outdone, brought a legal twist to loans. They introduced the idea of collateral and complex loan contracts, essentially setting the stage for the financial systems we use today. Moreover, Roman law provided protections for both lenders and borrowers, a practice that still influences our contracts in modern times.

By the Medieval period, the Church’s strict prohibition on usury (charging interest on loans) led to some creative workarounds, such as the “montes pietatis.” These were charitable loan institutions in Italy, offering low-interest loans to the needy, essentially the forerunner of today’s non-profit credit unions.

The Renaissance and Birth of Banking

With the Renaissance came the birth of modern banking. Italian banks, especially the Medici family, became the pioneers of new credit systems, creating letters of credit that allowed merchants to travel and trade without carrying vast sums of money.

This development laid the groundwork for our contemporary banking system, making it possible for us to enjoy conveniences such as online banking and instant loans. Imagine explaining ATMs to a Renaissance banker—they’d probably think it’s sorcery!

The Rise of Modern Credit Systems

As we move into the 18th and 19th centuries, industrialization accelerated the evolution of credit and loans. Lenders began to diversify, offering specialized loans for business ventures and personal needs. The era also saw the birth of credit reporting agencies—and yes, they’re the ancestors of today’s credit bureaus. What’s your FICO score, Julius Caesar?

The 20th century brought even more innovations, from credit cards to peer-to-peer lending platforms. Today, loans and credit systems are integral to economies worldwide, enabling individuals and businesses to achieve their goals. If you’re looking to stay updated on modern economic trends, Telegram Channels for Economic News offer invaluable insights and updates.

Jokes Aside: The Serious Impact of Credit and Loans

While we’ve had some fun exploring this topic, the development of credit systems has had a profound impact on social and economic structures globally. The ability to borrow and lend has driven innovations, economies, and even societal advancements. So, next time you swipe your credit card or apply for a loan, remember you’re participating in a practice as ancient as civilization itself!

For those passionate about diving deeper into economic theories and financial practices, exploring Top Economics Telegram Channels can provide a treasure trove of knowledge. Happy learning!